I’m going to open this blog post with something that most would consider has nothing to do with trading reversal patterns or trading at all, yet it is a very important theory to put in the forefront of your mind.

Complexity Bias:

is a logical fallacy that leads us to give undue credence to complex concepts. It’s our tendency to look at something that is easy to understand and then create a state of confusion and view it as having many parts that are difficult to understand. Humans often find it easier to face a complex problem than a simple one.

In my opinion, knowing oneself is just as important as knowing different patterns, moving average systems, stochastics, relative strength index, and the thousand other indicators that you could use to trade with. To be a massively successful trader lies in your ability to take pain. Are you willing to look like an idiot (quickly closing trades that are failing)? Do you have the courage to analyze what the error (errors) was to get better? How much risk are you willing to assume, and, most importantly, can you swallow the losses?

There are perhaps more potential types of patterns than there are traders. Traders must decide for themselves which patterns work for their own style of trading. It is extremely important that you find something that suits your personality style in the time frame and profit potential. In this blog post, I’m going to review Scott Carney‘s Shark Reversal Pattern. I always look to be completely transparent, and I must state that I have never traded any of Scott Carney’s patterns or read any of Mr. Carney’s works. I am in no way here to disparage any of his work and if it helps traders become profitable it’s all the better. Having been involved in trading for over 30 years his research was long after my teeth-cutting era, and it’s from an old-timer’s view I break down the trade step by step and then offer some old-school simpler alternatives.

Before we begin with breaking down the pattern and what steps are needed to find the pattern. I wish to state that it is very important to be looking for a specific bullish pattern in an upward-moving market for the time frame that you’re looking at, and conversely looking for a bearish pattern in a downward-moving market in the time frame that you’re looking at. The time frame that you’re trading at is extremely important because you cannot trade a longer-term trend in a shorter time frame market. For example, in an Upward(downward) moving market on a daily chart many of the closing prices are equally distributed as up and down closes, proving that anything can happen on a shorter-term chart it’s the length of the legs that determines bull or bear movements.

Shark Pattern

It is considered a bullish wave if you are starting from a low and moving upward to a top.

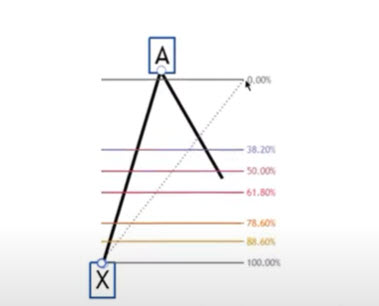

The shark pattern has five specific points. It starts off as an impulsive wave (bullish or bearish) Whereas you would label the origin as X and the end of the first run as A.

. You measure the leg using a Fibonacci retracement of X to A and look for point B to between 38.2 and 61.8 percent to find point B.

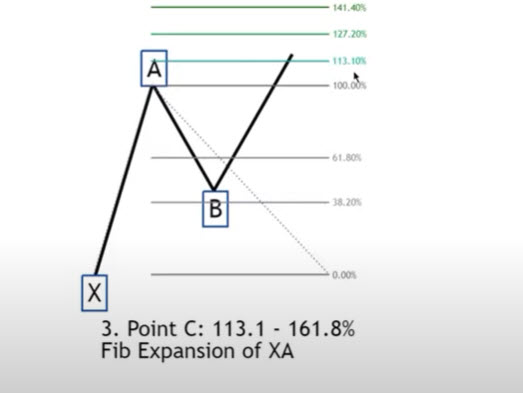

To continue with the pattern the next step is to find Point C. We again use a Fibonacci extension from X to A and look for a point that is higher than point A which should be between 1.13% and 1.618 extension of that leg.

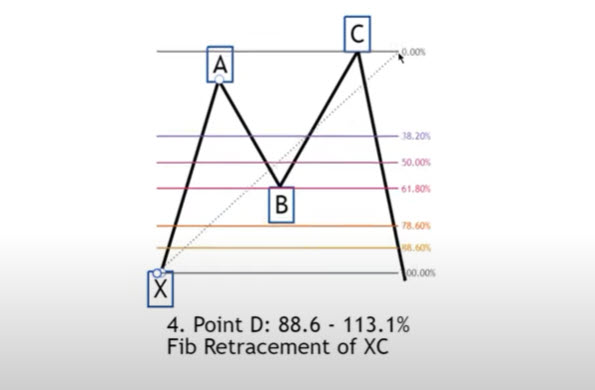

To find point D we need to do 2 measurements: a measurement of point X to Point C the market must retrace to .886 or slightly deeper to 1.13% of that leg. Just to clarify, point .886 is the square root of .786. Now.786 is the square root of the golden mean of .618, and 1.13 is the reciprocal. See how we love to get complex.

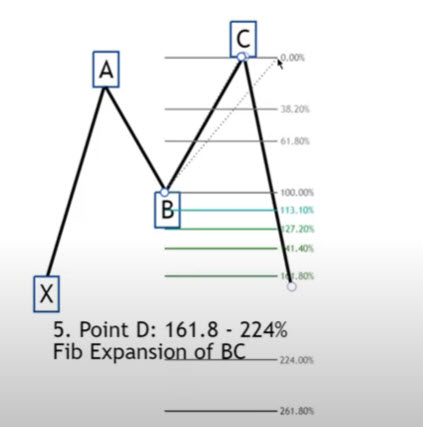

. The second measurement is a Fibonacci expansion from B to C in the direction of point D that lands between 1.618 and 2.24% level. In my opinion the deeper the retracement below point X the better as it should be more forceful in cleaning out recent short-position traders. The trigger point is at this level. Now for the old school “simpler” pattern the named Descending Wedge Reversal Pattern.

Descending Wedge Reversal Pattern:

The Descending Wedge pattern(Bullish Pattern) or a Rising Wedge Pattern (Bearish pattern) also has five distinct points: the key to finding it, and trading it accurately is identifying the points correctly. As I stated earlier it is important to look for the pattern in the direction of the trend that you are trading on your time frame.

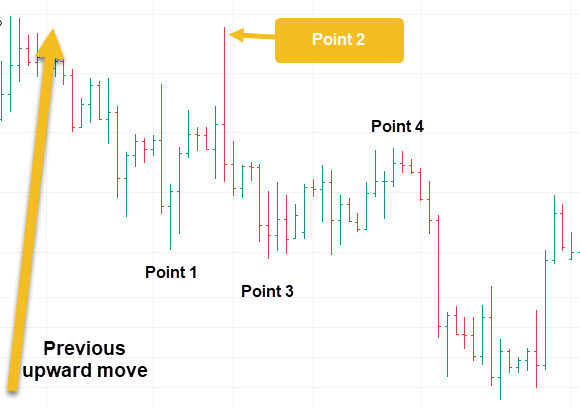

When looking for a bullish wave we start from a Top, and we label that point 2. We Start From Point 2. To find point 1 next image.

The Demand point origin is labeled Point 1. It was the low of point 2.

Point 3 is a lower low to point one either slightly lower or deeper. This low at 3 is slightly lower than Point 1 and will become the basis of our search for Point 5.

Point 4 is the Top of the rally after point 3 it cannot exceed point 2.

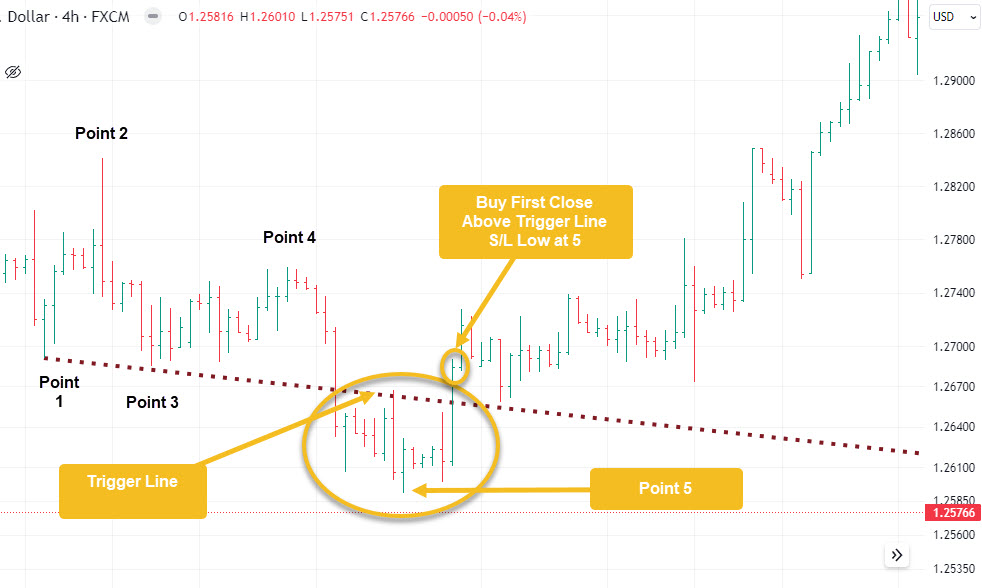

To Draw our Trigger Line and find point 5 we extend a line from the low of point 1 through the low of point 3. ( more on that later in the article)The lowest point under the line becomes Point 5. We buy the First Close above the Trigger Line with an S/l at or slightly lower than the low at point 5. Now the neatest little trick with this pattern is shown below.

With the pattern, you can project a Target. You place a Trend Line from the low of Point 1 through the High of point 4 to extend into the future for a target. One little trick that a trader on my desk would do when looking for and trading the pattern would use the point one low through the Close of Point 3(this is the addition I mentioned earlier) if the line was too steep, and do the same at point 4 if the target was too parabolic.

The simplest way to find a Bullish wave is to look for 3 descending low points and work backwards to find the trigger line and target line. So as you can see the Shark pattern and the Descending Wedge are similar but the Descending Wedge is not measured.