I met Roger White for a draft beer and some Fish and Chips at Fraunces Tavern, one of my favorite Taverns in NY & the States.

Roger once said to me, “The burned child fears the fire and stays far away, the scorched trader keeps going back to the same methods and is scorched again.”

In my early years of attempting to develop a system, I was getting scorched more times than I cared to remember.

I was trying “canned” and rehashed systems like MACD, RSI overbought – oversold indications, Stochastics etc. All miserable failures. I wanted his opinion on these systems and what I could do to get them to perform better.

So I said, “Roger I am getting my ass kicked with these systems. If I didn’t have my customer orders I would be severely in the red. Other trader buddies of mine, just say trade the orders and make (take) your money. But I have been thinking about what you said…I will never feel the thrill of abundant profits…and I certainly will not be able to trade on my own as things stand now! I am really frustrated and a bit scared!”

“Tom, fear on one hand is good. It shows deep down that you are prudent, and are not filled with self-aggrandizement. It’s bad on the other hand because it can be paralyzing! When a trader does not know what to expect with his system he becomes paralyzed! You can’t trade from the state of being paralyzed. How many times have your systems failed you, compared to their probability and expectancy, and the dollar cost to your P/L?” He asked.

“I don’t know… I am still up on the quarter..but really if I had to guess.” He then quickly cut me off and very sternly stated…

“I don’t want to hear that horse$hit. YOU DON’T KNOW? YOU FU%KING DON’T KNOW!? Are you kidding me right now?”

“Roger, I am sorry to get you upset, but I was being as candid as I could,” I replied.

“Tom, you are PLAYING with systems and you don’t understand their Probability or Expectancy. You don’t know what the cost P/L wise was, or how many times they failed. It’s no wonder you’re frustrated and a bit scared. Now I am not saying they are good systems, as I don’t really know them…But what I do know, is that YOU DON’T KNOW!”

He continued, “When you enter the market like that it will seem like chaos, but understand that within Fake Chaos there is opportunity! Did Aldo allow you to trade those systems?”

“Aldo doesn’t care what I trade as long as it is profitable on the quarter,” I replied

“Exactly, and the market doesn’t care either. You see the market may appear to be unstructured and unlimited until YOU give it structure and limitations. You give it structure and limitations through your systems. In a seemingly unstructured and unlimited space, you need to establish RULES for yourself. You broke a very important rule, do you know what that rule was?”

“I Have no idea Roger…really… I am sorry to say,” I replied

“The rule you broke that set me off was that by just flippantly trading these systems you avoided creating defining rules, therefore shifting the responsibility of the losses onto the SYSTEM! You started off our conversation about how the systems were kicking your A$$. You kicked your own A$$! Because you didn’t define rules for the systems that you decided to trade.”

Then he asked me if I wanted to be an Average Trader or a Master Trader…

“Master Trader that’s what I strive to be,” I quipped.

“Well, Average Traders never want to define rules, because they will then have a way to measure their own performance, and that will hold them accountable to their results. Average Traders do not want accountability. They just want to make money with no direct connection to their own performance. How the hell can you do that?

Master Traders on the other hand take full responsibility for their actions. They know they are where they are, through the decisions THEY made. No mysterious market forces were working with them or against them!”

Here’s the key lesson he shared with me that day…

“Master Traders anticipate market future events. They plan their trades in advance with contingencies. They know their plan for the time being is either working or not working. When not working they escape, either way, they have the stones to put their creative abilities on the line making themselves accountable to themselves.”

I felt as if I had just been scolded by my 5th-grade Math teacher. I felt awkward but understood exactly what he was saying.

I needed to take full responsibility for my trades and my trading systems.

He said, “Canned trading systems rarely work! Do you feel comfortable with the Moving Average Crossover, Tom? Do you think big Profits are possible?”

“No.” I replied

“So ditch the idea. Don’t keep going back to what scolded you. Move on. What technique has made you money and comfortable at the same time?”

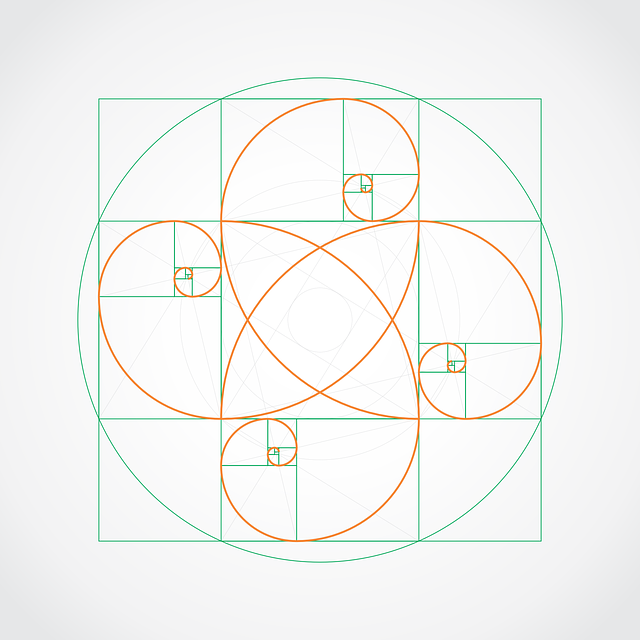

“I have had success with Fibonacci Levels and Breakouts.” I said

“Then I suggest you study only Price Action and not look at an Average that happened X bars ago. Work on a system that incorporates those techniques. Figure out the expectancy and probability for at least 100 trades. Now drink up, enough with this market talk for now. Cheers!”

Do you want rules you can follow?

What about a way to give the market a structure?

How about a way to plan for future market events (this is the big one)?

Download Forex Confidant today!.

You’ll see where the above discussion led me…and what understanding price action can do for you!